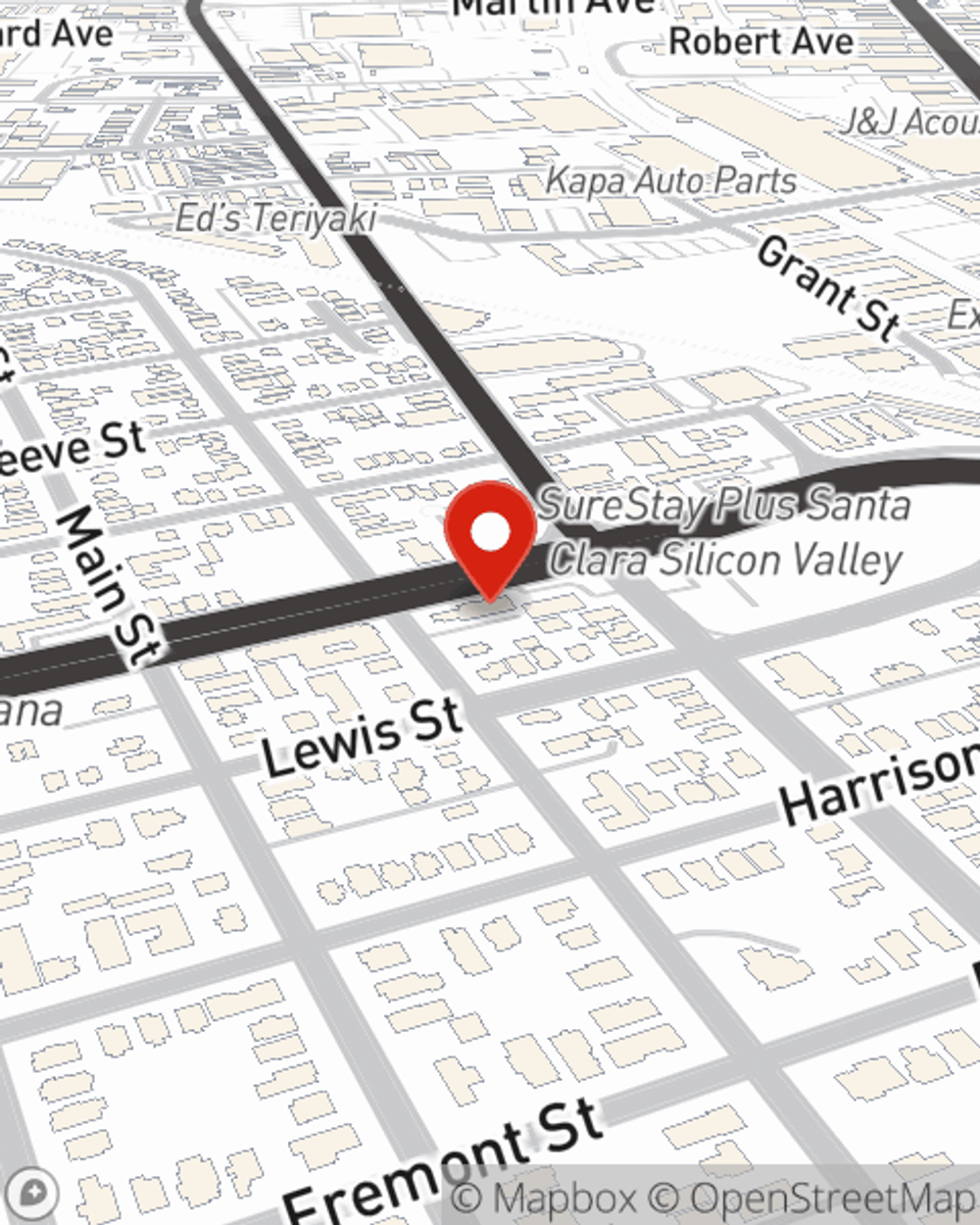

Business Insurance in and around Santa Clara

Calling all small business owners of Santa Clara!

No funny business here

Business Insurance At A Great Value!

When experiencing the highs and lows of small business ownership, let State Farm take one thing off your plate and help provide excellent insurance for your business. Your policy can include options such as worker's compensation for your employees, a surety or fidelity bond, and business continuity plans.

Calling all small business owners of Santa Clara!

No funny business here

Insurance Designed For Small Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Alexandra Anderson for a policy that safeguards your business. Your coverage can include everything from worker's compensation for your employees or errors and omissions liability to employment practices liability insurance or mobile property insurance.

Agent Alexandra Anderson is here to discuss your business insurance options with you. Contact Alexandra Anderson today!

Simple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Alexandra Anderson

State Farm® Insurance AgentSimple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.